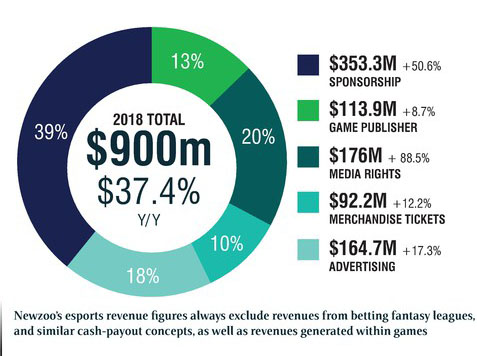

According to Newzoo’s Global Esports Market Report, 2018 will see the global esports economy grow to $900m (£685m), a year-on-year increase of 37.4%. Brands will account for 77% of this spending, broken down into $165m on advertising, $353m on sponsorship and a further $176m on media rights. Consumer spending on tickets and merchandise throughout the year will amount to $92m. Another $1 14m will be invested by game publishers into the esports industry through partnership deals with white-label organisers.

Content rights take centre stage

This year has seen an accelerating shift of business models from direct advertising to indirect monetisation through media rights sales. Content rights are sold by game publishers directly or through independent event and league organisers such as GPL, ESL and Dreamhack. Buyers consist of a growing group of traditional/digital media companies interested in acquiring rights locally and on a global scale. By selling these rights, the publishers and organisers do not receive a share of direct advertising revenues from streaming their esports content.

Serious money is changing hands at the top of the esports pyramid for events and leagues. For both tournaments and leagues, most revenue growth will be driven by top-tier events. The biggest opportunities for content buyers could now lie in the second- and third-tier tournaments and leagues, as these events have local power or serve a more niche audience.

Adding to buyers’ interest in esports content is the fact that content for almost every major traditional sports league (from soccer to baseball) is tied up in contracts for the next few years. Esports, on the other hand, has contracts aplenty that broadcasters (endemic and non-endemic) are now vying to get hold of.

What’s more, new direct monetisation options for content have started to appear across the industry, including premium features and content passes. The Overwatch League All-Access Pass, for instance, gives viewers access to exclusive shoulder content, additional camera angles and a personalised viewing experience. This more direct ROI will further justify an increase in content rights spending, but this depends on whether consumer monetisation is included in media rights deals.

Global esports viewers will total 395 million

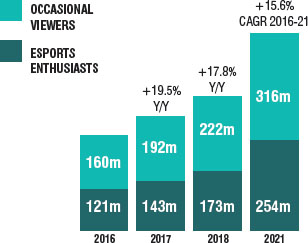

The global esports audience will reach 395 million this year, made up of 173 million esports enthusiasts (those who watch esports content once a month or more) and 222 million occasional viewers (watch esports content less than once a month). In traditional sports, total revenue per fan is a key indicator of how well a sport is monetised. This includes all revenue streams, including media rights, sponsorships and consumer spending. Based on Newzoo’s audience and revenue expectations for 2018, the average revenue per esports enthusiast in 2018 will be $5.20, up 14% from 2017. As the esports industry matures and the number of local events, leagues and media rights deals increases, Newzoo anticipates the average revenue per fan to grow to $6.30 by 2021. This is still significantly lower than popular traditional sports such as basketball or football.

Local initiatives thrive in western Europe

North America will remain the largest esports market in 2018 with revenues of $335m and will show impressive growth to reach $639m by 2021. Most of these revenues will come from sponsorships, which will grow from $100m in 2017 to $155m in 2018. This figure is boosted by the number of North American teams that have welcomed new non-endemic sponsorships and the region hosting several of the world’s largest leagues and tournaments. Western Europe is the second-largest region in terms of revenues with $172m in 2018. China is also a booming esports economy with estimated revenues of $169m in 2018 and a total esports audience of 134 million. The country is notable for the growing popularity of mobile esports, including casual titles.

The future of esports

With the number of viewers that esports attracts, there is no doubt it will grow to a multi-billion-dollar industry in the coming years. The only question is at what pace this will occur. After an initial growth phase, the overall structure of the esports industry has become clear. However, business models aimed at increasing revenues per entertained consumer are still being tested. Esports has now moved into its adolescence and there are some key factors that will influence the speed of its growth. On its current trajectory, Newzoo estimates the esports industry will reach $1.7bn by 2021.

Jurre Pannekeet is head of sports for Newzoo, having joined as a senior market analyst two years ago. An avid esports enthusiast, Jurre’s focus is on modelling the esports economy, nding and dissecting key trends and assisting brands in shaping their esports strategies.