Scientific Games ponders social spin-off

Scientific Games has revealed plans to launch an initial public offering for a minority stake in its social gaming division.

The business, comprising social casino apps including Jackpot Party, Bingo Showdown and Monopoly Slots, has consistently grown. The company first moved into social in 2013 through the acquisition of WMS, which had launched Jackpot Party a year earlier.

In the business’ results for the third quarter of 2018, revenue from social was up 11% year-on-year to $105.1m, with adjusted EBITDA climbing 34% to $27m.

The quarter also saw monthly active users rise 6% to 8.4m, with average daily revenue per daily active user climbing to $0.43. The division has also succeeded in shifting to a mobile-first business, something that competitors such as Zynga struggled to do, with 79% of revenue coming through the channel in Q3.

“We believe an IPO would provide greater flexibility to pursue additional growth initiatives, specifically designed for our social business as well as unlocking additional value for Scientific Games’ stakeholders,” Scientific Games chief executive Barry Cottle explained.

Cottle added that the social was the only business unit that merited being spun off, as a result of it being the only customer-facing division. All others, were B2B-focused, with technology and solutions interlinked, making it harder to separate each into distinct entities.

Money raised through the IPO is to be used to pay down the supplier’s long-term debt, which stood at $8.7bn

Most read on iGamingBusiness.com

1) Gibraltar wins Spanish support for gambling future

2) UK raises remote gambling duty

3) Unibet expecting chess final bonanza

4) William Hill tables £242m offer for MRG

5) Ladbrokes may face mass payout on ‘cancelled bets’

Most popular premium

1) William Hill buys Green (and a touch of grey)

2) Social casino: Q4 update

3) iGaming Tracker: UK online bingo mix

4) Long read: Business as usual

5) Wiggin EU round-up – November 2018

Top tweets

1) NJ sports betting hits milestone $500m figure

2) Grant Williams quits Hills ahead of online overhaul

3) Unibet rapped for ‘sponsored’ Henderson tweet

In their own words…

“It’s this ongoing interrogation by industry peers that ensures disruptive products develop the characteristics that givethem their longevity”

JEZ SAN, FUNFAIR, PAGE 18

“Marketing departments are being asked to do a lot more, and haven’t seen pay rises to reflect theincreased workload”

GARETH MULLEY, PENTASIA, PAGE 55

“[The sector] contains most of the ingredients necessary to make investors potentially view [it] as something of a dog”

PAUL LEYLAND, REGULUS PARTNERS, PAGE 111

In numbers

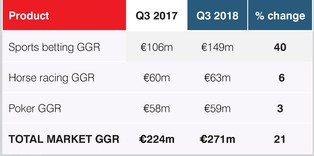

The French iGaming market, the source of huge excitement when it opened in 2010, has since been held up as an example of what not to do when re-regulating a gaming market. Hefty taxes have made it almost impossible for many to turn a profit, leading to an exodus of operators. However, things seem to have taken a turn for the better. Poker, following years of decline, has recovered, due in part to the launch of liquidity sharing with Portugal and Spain. Industry efforts to revitalise horse racing are paying off. And the French betting public has fallen in love with sports betting. The vertical began life as an afterthought, but has now climbed to the summit of the market, and growth shows no signs of slowing. It remains to be seen what regulatory changes will be prompted by the government’s sale of its majority stake in La Française des Jeux, but some suggest that it may finally see the market expanded beyond the three legal verticals. The operators that have exited the market may soon be considering moving back in.

GOOD TIMES

THE STARS GROUP

The operator formerly known as PokerStars has long profited from its absolute dominance of the poker vertical, but it has had the foresight to realise the importance of diversification. This has seen it make almost as big a splash in online casino as it made in its core vertical, but sports betting, via the BetStars brand, has proved a trickier nut to crack. A multi-billion dollar M&A splurge later, however, and The Stars Group has seemingly resolved all its betting-related inadequacies. Group revenue soared to $572.0m for Q3, with Sky Betting and Gaming and the Australian BetEasy businesses helping the contribution from sportsbook to jump from $11.7m to $154.8m. While increased operating expenses resulting from the acquisitions almost wiping out profit for the period, it’s a sign of The Stars Group’s strength that it can complete two major acquisitions and still post a positive result.

BAD TIMES

SPORTECH

Having gone from issuing a profit warning to losing its chief executive in a week, Sportech is facing tough times. This, ironically, is happening during a period where everything it had appeared to be working towards should be coming to fruition. In recent years the company has appeared to be positioning itself to be an early mover in the US sports betting market, but with PASPA a thing of the past, it has quickly been outstripped by larger, more nimble peers. This has culminated in a warning that full-year EBITDA would fall up to 10% below its projections, as a result of “certain expected sales contracts” not being signed. Now chief executive Andrew Gaughan, with the company since 2004, has announced his departure just months after taking the top job. When Gaughan took on the role the company said it would no longer entertain offers from prospective acquirers. It’s now banking on sports betting being legalised in Connecticut – if it fails to make a splash in that market, it may soon be back to looking for buyers.