THE UK

CARA KERR, PRINCIPAL IGAMING CONSULTANT

London is still clearly the hub of gaming activity, although here consolidation has caused some talent displacement, with talent forced to look elsewhere if committed to utilising their industry specialism. London however is still a good place to be – a key technology hub with lots of activity within the largest market. We have seen a rise in companies heading north or outside of London, and often even outside the UK’s other tech hubs. It is challenging to find talent there but often attractive for senior candidates looking for a lifestyle change and long-term benefits. We have seen some big customer service and other departments leave London as consolidation can result in duplication of such functions.

GIBRALTAR

CARA KERR

The Brexit effect has not been noticeably evident, although clearly the effects of the coming few months could be significant. Salaries are still growing, and while the rate of new companies setting up has slowed and others are relocating, this is offset by growth with no major closures and large companies still moving teams out there. It is a small market for talent and not for everyone, but can be an attractive option, particularly as the mid-level talent shortage can provide a good career path towards senior roles.

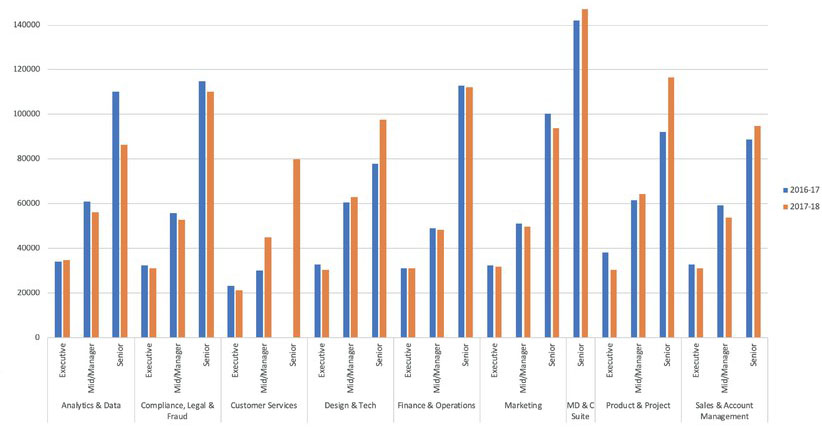

Source: Pentasia

SCANDINAVIA

HENRY PETERSEN, PRINCIPAL CONSULTANT, SCANDINAVIA

Relatively steady in terms of salary levels, and whilst entry level salaries may have fallen, the pay-off for those with a minimum of 2-3 years’ industry experience continues to be appealing. Scandinavian operators are still basing as many roles as possible in Malta, and want to continue doing so.

The effects of Swedish regulation from 2019 remain to be seen, but considering regulators’ close partnership with the major operators is unlikely to bring any major surprises, although licence requirements could upset the balance. Marketing teams’ workload will likely increase, as much of the Swedish regulation will affect their campaigns and CRM output. The key shortages for Scandinavian operators at present are within affiliate and CRM, with the responsibility for compliance falling on the whole business.

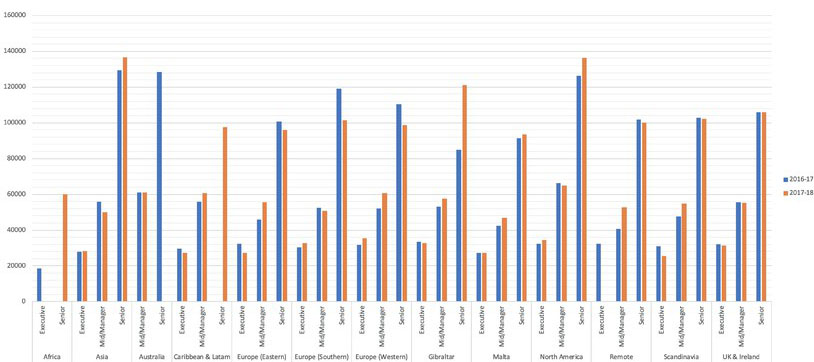

Source: Pentasia NB: Datasets for Africa, Asia, Caribbean/LatAm and remote too small for reliable reading

SPAIN

GIULIANO LAFIRENZA, HEAD OF SPAIN AND LATAM

Spain remains an attractive region not only for its market but also for the quality and size of its gaming talent pool. New tech teams continue to set up in Barcelona – Londonbased firms hiring in Spain generally find a good range of strong candidates, sourced either within region or from further afield as expat candidates look to bring their experience back home. Barcelona and Madrid remain the top locations for gaming operations with talent clustered around these areas. The gaming sector largely employs specialist leadership talent, marketing functions, operations and customer service, whilst locating more substantial teams – such as tech – elsewhere in Europe. The main challenges are the sector’s own expansion due to the issue of more licences and of closely related industries such as ecommerce, fintech and payments. The growth of Spain’s wider tech sector is good for gaming, but employers need to remain aware of new out-of-sector jobs which may attract valuable staff. As for the recent tax changes, operators looking to benefifrom a Ceuta or Melilla location will need to base senior leadership talent in the North African cities, a potential opportunity for many candidates, but unlikely to appeal to all.

NORTH AMERICA

MARWA MITCHELL, VP RECRUITER FOR NORTH AMERICA

The opening of the US sportsbook market has primarily affected the top of the chain, with senior salaries the first to be raised in order to attract suitable candidates. US incumbents and European entrants urgently need experienced senior execs on the ground and are willing to pay. Although with financial returns as yet unproven, there’s a limit to the purse strings. Now the initial excitement is over, employers are cautious not to over-value candidates. Visa restrictions are also severely limiting the inflow of talent from elsewhere in the world. Those with existing citizenship or the potential to work are in short supply, even potential supply from more the supposedly more favourable Australian visa is not proving fruitful.

Mid-levels can be attained locally and out-of industry, with the right senior leadership to provide guidance and industry expertise. The local talent pool is now increasingly open to moving inter-state. Even those with long-held roles realise the huge potential and are more open to the trend towards training people.

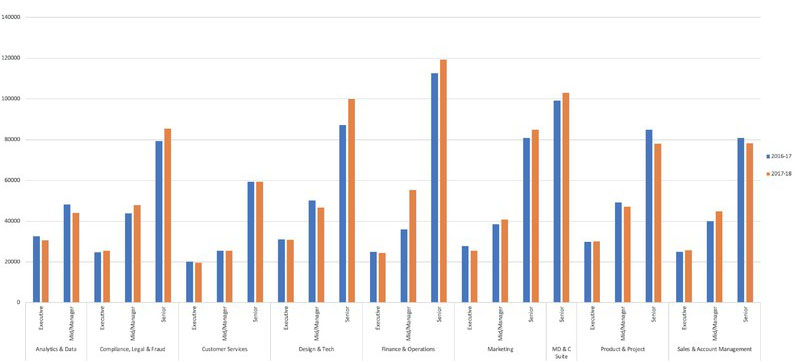

Source: Pentasia

MALTA

ANTHONY HENNESSY, HEAD OF PENTASIA MALTA

The island still has a major talent shortage exacerbated by the influx of new operators. Malta has a clearly established ecosystem for the island’s big operators, while more exciting startups provide an often-attractive shot at more immediate success, with accompanying risk.

The biggest salary increases are in businesscritical operational leadership – areas where compromise or out-of-industry hires are not an option – such as compliance, senior tech roles, finance and operational management.

The shortages are particularly painful at the mid-management level and include affiliate, account and customer service managers – where it really slows business pace – but employers are still not always willing, or able, to increase salaries to attract these. Affiliate specialists are particularly in demand because it takes time to build a B2B network. The senior roles get filled by experienced people, but it leaves openings for managers and executives. Some companies are training people up, but this is rare despite most having a pressing need in this area.

The main in-demand languages are Swedish and German, although it remains difficult attracting these people in competition with their home country.

The cost of living is increasing – candidates now tell us €23k is the minimum to achieve the most basic lifestyle – with junior staff often prepared to move abroad to get this. This is causing some customer service operations to flow away from Malta.