In the post-dotcom era, a handful of technology companies have risen to the mythical status of unicorn ($1bn+ valuation), or even super unicorn ($100bn+). The huge publicity surrounding these companies, which include the likes of Alphabet and Amazon, makes it tempting to see the rise of unicorns as a growing trend. But that’s not necessarily the case. In fact, as the fairytale-inspired name first coined by the venture capitalist Aileen Lee suggests, they are still exceedingly rare, with only 0.07% of start-ups ever reaching such rarefied status.

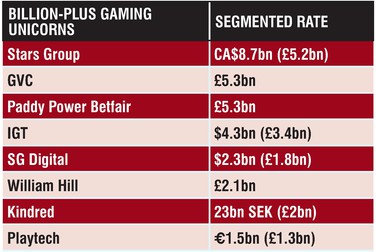

This is especially true in the gaming industry, where only a handful of companies have ever been able to claim multi-billion-dollar valuations. And in almost all cases, they are publicly listed operators that have only broken the billion-dollar benchmark through one or more significant key acquisitions (see Figure 1).

Consolidation among the big players in the sector has accelerated in recent years, with mega deals materialising principally for the following reasons:

• an emphasis on squeezing out the competition;

• expansion into new territories via large-scale mergers;

• land grabs in regulated markets; and

• forward-thinking regulatory opportunities in emerging (and soon to be regulated) markets.

These drivers have seen Paddy Power Betfair, GVC and the Stars Group all successfully execute multi-billion-dollar deals to consolidate dominant market positions and play on a more global scale, particularly with the sportsbook-led opening of the US.

European markets, according to Thompson Reuters Intelligence research, have seen a resurgence in cross-sector mega deals, with the value of M&A activity doubling year-on-year in the year to date. Interestingly, though, the number of transactions has fallen by 18% to 6,201, the lowest level since 2005. So fewer companies have been buying, but when they have they’ve been digging deep.

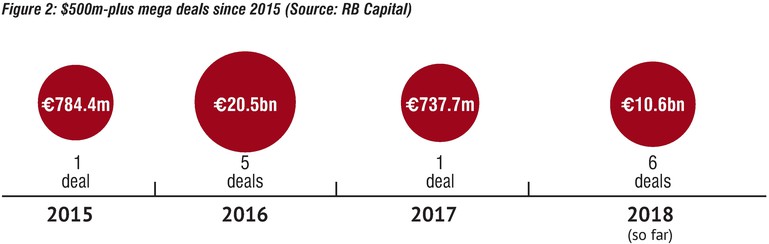

The same can’t be said for gaming. RB Capital’s M&A Monitor data has highlighted a fluctuation in €500m-plus mega deals (see table), with €32.6bn spent in the last four years, a flurry of five huge acquisitions materialising every 24 months, and a minor downward trend in deal size from 2015 to the present day.

Both 2016 and 2018 have seen the largest splurges with €20.5bn spent on deals two years ago, including the two mammoth mergers of Ladbrokes-Coral and Paddy Power-Betfair, while 2018 so far (total spend of €10.6bn) has had a distinctly new market feel about it.

This year has seen Paddy Power once again active in acquiring US fantasy sports brand FanDuel, the Stars Group splashing out €4bn to purchase Skybet and serial accumulator GVC coming back for more following its 2017 Bwin acquisition by snapping up the recently merged Ladbrokes Coral business.

Some commentators have suggested blockbuster transactions have had their day, with the most significant deals already done and those businesses now predicted to pursue more organic growth strategies. But there are many reasons why further M&A action is on the cards.

Just the beginning

The number of mega transactions may have fluctuated in recent times but there is still huge value to be found across an array of growing assets.

Five years or so ago, most deals in the UK and Europe were driven by a mission to boost or establish scale or rapidly gain first-mover market share in regulated or soon-to-be regulated markets. However, most 2018 deals have been steered by the promise, and now growing reality, of US state-by-state regulation.

Although it is early days for other states to jump on the bandwagon, investor appetite from US operators and European suppliers has been intense. And with ‘real’ revenues now coming through Nevada ($247m in wagers in August), New Jersey ($100m) and even Delaware ($17m), this is only set to continue. Remember this has all happened during the traditionally quiet period ahead of the busiest months for sportsbooks of October and November, when all four major US sports’ biggest events coincide.

Crucially, there has been a shift in the structure of recent transactions and we have seen a spike in interest from private equity and venture capital firms as several states open for business and others look to follow suit.

Sportradar and Genius Sports have both been the focus of VC/PE investment that aims to capitalise on US market expansion. Interestingly, both companies offer data services, which savvy investment firms know will always be in demand, and thus offer stable and consistent annuity revenue unaffected by high customer acquisition costs, taxes and/or levies. They will also be invaluable when aiming to engage and retain existing players and acquire and attract a new, younger, mobile-first audience.

These are far from small deals. Indeed, the Canada Pension Plan Investment Board has teamed up with growth equity firm TCV to part with more than $700m in exchange for a 39% stake in Sportradar. Meanwhile, renowned PE investor Apax Partners, which has previous gaming experience investing in, and since exiting, Candy Crush developer King, went one step further. It swallowed up sports data and media rights distributor Genius Sports Group with the capital injection allowing it to pursue its international expansion strategy, largely in the US.

We expect these types of structured deals to continue, especially around data-driven software suppliers and fast-growing platform providers, with exit valuations that will tempt even the most risk averse PE/VC firm given their medium- and long-term outlook.

The potential of a larger-scale re-regulated US gaming and betting market is finally turning heads, then. But while attention has been focused on cross-Atlantic activity in recent months, we shouldn’t neglect European M&A. It is worth remembering that the everchanging nature of markets here, alongside several other factors, is likely to encourage further M&A and potentially far more mega deals than in the US.

The first driver of this lies in the pressures created in dot-country markets and by increasing regulation across Europe. We are seeing these in regulated markets (including the overly saturated and increasingly volatile UK), maturing regulated markets such as Italy and Spain and recently regulated markets in developing regions such as Eastern Europe.

In the UK, several operators are managing increasingly severe financial regulatory fines for repeated marketing abuses. Next year will also see the UK and various licensed jurisdictions, among them Gibraltar, Alderney and the Isle of Man, confront an unclear and worryingly uncertain future outside the European Union.

These pressures may drive stakeholders to sell or divest certain assets, while intensifying competition in other mature territories will continue to push an increasing number of smaller brands and suppliers to speed dial the right sell-side brokerage.

In maturing regulated markets such as Italy, where reputable brands are still working out how to market products under a draconian advertising ban, and Spain, which was initially hard to operate in but is now showing promise following a change in the tax regime, participants will see M&A as a medium-term option to either get out for good or remain and push for increasing market share.

Lastly, in newly regulated and regulating markets including Romania, Czech Republic, Bulgaria, Poland and others, expect a return to the good old land-grab days. There, experienced deal makers such as GVC are already making incursions into markets such as Georgia with an eye to the future and educated, mobile and tech-savvy audiences.

Other operators are sure to follow GVC’s lead into these markets, but with many of the transformative transactions in the sector having now completed, it will become harder for other gaming companies to join them among the ranks of the unicorns.

In summary, over the next 18-24 months expect ever more creative acquisitions stateside as buyer risk starts to fall in the face of medium-term gains.

On this side of the pond we anticipate a flurry of short-term UKbased activity with players exiting while they’re (pre-Brexit) ahead.

Medium-term M&A is expected to be strong for central and southern Europe. And the Nordics will (as always) be at the mercy of longer-term pension fund trackers. The M&A market will remain flush with activity for a good time to come. So watch this space.

Ben Robinson is co-founder of boutique advisory firm RB Capital, focused on the igaming, fintech and media sectors. RB Capital works with both start-ups and scale-ups looking to raise capital and also established companies looking to take their business to the next level or initiate a liquidity event.