Welcome to the first-ever iGaming Business industry salary survey in partnership with the sector’s leading recruitment agency Pentasia. Their data experts have segmented the advertised salary data from its global network by job, grade and location to give the industry’s most comprehensive and detailed insight into sector recruitment trends to date.

With the analysis starting in 2016-17, enabling benchmarking of the data from this point, it is understandably tempting to look for patterns or evidence in the data of the forces that have reshaped and buffeted the sector in recent years, from consolidation, to CSR and compliance pressures, impending Brexit and, of course, regulation and tax changes.

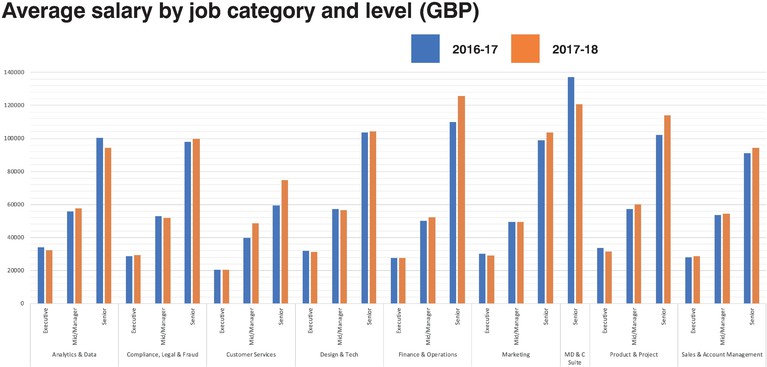

Turning first to the headline findings, the sector as a whole saw 2.7% increase in average salaries in 2017-18 compared to the prior year, broadly consistent with wider trends, the UK jobs market for instance experiencing 2.8% growth in the period.

As Pentasia MD Alastair Cleland comments, this underpins igaming’s status as “a thriving and growing market, with a talent shortage that continues to favour candidates”.

The headline figure however masks some huge variances within the data, most significantly with regards to seniority.

As shown in the bar chart opposite, growth has been far more pronounced at the uppermost levels, widening the gap between senior and managerial pay. Cleland provides analysis of this on the opposite page.

There are also vast differences in the annual salaries paid by companies to candidates for doing the same job at the same grade. Thus while the average annual MD/C-suite salary was £128k across the two-year period from 2016-2018, the top 10% earned an average of £235k. Similarly, in senior marketing roles, the average earned was £101,500, while the top tier took home £176,000.

It’s also fair to assume that this upper 10% has a distorting effect on the overall average for each job category, meaning that many reading this survey who consider themselves to be earning the norm may not necessarily see their pay measuring up to this.

Viewed from a regional/jurisdictional perspective, the hike in senior level salaries was most prominent in Gibraltar, up 42% year-on-year.

Principal igaming consultant Cara Kerr told iGB: “The ‘Brexit effect’ has not been noticeably evident – though clearly the effects of the coming few months could be significant.”

In Malta, set to receive the biggest post-Brexit boost from the Crown Dependency licences losing EU (grey) market access when the UK leaves in 2019, average salaries were up 3.4%, above the overall industry growth rate but behind the UK and Ireland with 5.84%.

Head of Malta Pentasia Anthony Hennessy says the island is suffering “a major talent shortage exacerbated by influx of new operators”. The gaps are “particularly painful at the mid-management level…where it really slows the pace of business” and include affiliate, account and customer service managers.

A robust compliance function is of course becoming increasingly pivotal to building a sustainable business in the igaming sector, driven by recent reputation-damaging regulatory interventions and fines levied on operators for KYC, money-laundering, social responsibility and advertising failings in the UK. This has attached a growing premium to “senior compliance talent who can identify and make recommendations based on imminent and changing regulation”, says Cleland.

As for the impacts of the consolidation dance which has seen most of the major listed players combine in recent years, Cleland says the effects have been gradual as businesses have been careful to retain their most talented staff. “Displacement caused by merging teams has created some areas where candidate availability outstrips vacancies – such as London, where candidates are finding they must either travel for work or transfer to new sectors”, he adds.

Emerging and potentially disruptive tech is also attracting those with entrepreneurial tendencies away from the big igaming firms to smaller, more agile startups, with those building on blockchain and AI proving particularly magnetic, according to Cleland. He points out that: “ICOs have enabled these smaller operations to become cash rich quickly and enables them to offer highly attractive salaries alongside the chance of new success.”

Last but not least, remote working is becoming number one request on the candidate wishlist, but one that that sector employers are by and large still unwilling or unable to accommodate. “As the freelance and remote economy continues to grow, likely either employers or candidates will need to adapt or compromise, says Cleland.

Source: Pentasia

Mind the gap

Pentasia MD Alastair Cleland on the growing gulf between the top- and mid-range earners

Our industry rewards those at the top, but a salary gap between the top and mid-range earners is opening up, writes Pentasia MD Alastair Cleland iGaming is renowned as an industry where the big winners win big, with a number of directors and founders having amassed billion-dollar fortunes from their work in the sector.

The packages on offer to those lower down the ladder may not match this, but the iGaming industry tends to pay handsomely at all levels. This year’s salary survey shows pay across the sector has increased 2.75% year-on-year, but it’s the senior leaders who have enjoyed the biggest pay hike in the period.

Salaries in excess of £100,000 are increasingly commonplace, not just for the C-Suite but also for specialists and heads-of-department in areas including compliance, tech development and product management.

However as senior salaries have increased, the gap between mid- and senior-level pay has widened.

Bosses earning double the salary of those directly below them are increasingly common. This has created a top-heavy remuneration culture.

There are three factors contributing to the widening gap. First, an ongoing scarcity of experienced iGaming leadership talent drives up wages. Secondly, mid-level salaries are limited by precedent or comparable hires. Finally, senior roles often require candidates to relocate, which necessitates higher salaries to make the roles more attractive. Making the jump from a mid- to senior-level position is often seen by employers as challenging. This means many can be unwilling to recruit from lower tiers of their business for the most senior roles.

Often it takes a new employer to recognise a candidate’s potential and offer them the chance to step up.

Experience remains key, both for driving up salaries and securing the top jobs.

Those with a decade or more’s industry experience have a significant advantage over candidates from other sectors when it comes to landing senior roles. Ours is a unique and nuanced industry where knowledge and experience are valued.

Certain fast-tracks are now emerging. Experience in key operational departments such as tech, compliance or marketing boosts career prospects as employers look to build these skillsets into their leadership team.

In the increasingly complex, regulated and competitive online gaming market, it’s above all strong leadership that employers look for. Career paths which include a wide range of departmental interaction and exposure to different markets are most likely to result in a seat at the top table.

Ultimately, employers who invest their trust, responsibility and top-tier salaries in ambitious candidates who are willing to prove themselves – even if they haven’t yet done so – may discover that their investment pays dividends.